UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantþ ☑

Filed by a Party other than the Registrant¨ ☐

Check the appropriate box:

¨☐ Preliminary Proxy Statement

¨☐ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

þ☑ Definitive Proxy Statement

¨☐ Definitive Additional Materials

¨☐ Soliciting Material Pursuant to Rule 14a-12Under§240.14a-12

POLYONE CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ☑ No fee required.

¨☐ Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11.

| (1) Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

☐ Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) Filing Party:

(4) Date Filed:

|

NOTICE OF 20162019

ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT

PolyOne Corporation

|

| ||||

| ||||

|

April 1, 2016

Dear Fellow Shareholder:

You are cordially invited to attend the PolyOne Corporation Annual Meeting of Shareholders (the “Annual Meeting”), which will be held at 9:00 a.m. on Thursday, May 12, 2016, at PolyOne Corporation’s corporate headquarters located at PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012.

A Notice of the 2016 Annual Meeting of Shareholders, a proxy summary and the Proxy Statement follows. Please review this material for information concerning the business to be conducted at the Annual Meeting and the nominees for election to our Board of Directors (the “Board”).

You will also find enclosed a proxy and/or voting instruction card and an envelope in which to return the card. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return your enclosed proxy and/or voting instruction card, or vote by telephone or over the Internet as soon as possible so that your shares can be voted at the meeting in accordance with your instructions.Your vote is very important.You may, of course, withdraw your proxy and change your vote prior to or at the Annual Meeting by following the steps described in the Proxy Statement.

I appreciate the strong support of our shareholders over the years and look forward to seeing you at the meeting.

Sincerely,

Robert M. Patterson

President and Chief Executive Officer

PolyOne Corporation

|

| i | ||||

| ii | ||||

| 1 | ||||

| 7 | ||||

| 8 | ||||

PROPOSAL 2 — ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | 13 | |||

PROPOSAL 3 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 14 | |||

| 17 | ||||

| 23 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 30 | ||||

| 32 | ||||

| 37 | ||||

| 40 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| A-1 | ||||

|

March 28, 2019

Dear Fellow Shareholder:

You are cordially invited to attend the PolyOne Corporation Annual Meeting of Shareholders (the “Annual Meeting”), which will be held at 9:00 a.m. on Thursday, May 16, 2019, at PolyOne Corporation’s corporate headquarters located at PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012.

A Notice of the 2019 Annual Meeting of Shareholders, a proxy summary and the Proxy Statement follows. Please review this material for information concerning the business to be conducted at the Annual Meeting and the nominees for election to our Board of Directors (the “Board”).

You will also find enclosed a proxy and/or voting instruction card and an envelope in which to return the card. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return your enclosed proxy and/or voting instruction card, or vote by telephone or over the Internet, as soon as possible so that your shares can be voted at the meeting in accordance with your instructions.Your vote is very important.You may, of course, withdraw your proxy and change your vote prior to or at the Annual Meeting by following the steps described in the Proxy Statement.

I appreciate the strong support of our shareholders over the years and look forward to seeing you at the meeting.

Sincerely,

Robert M. Patterson

Chairman, President and Chief Executive Officer

PolyOne Corporation

Please refer to the accompanying materials for voting instructions.

| i |

NOTICE OF 20162019 ANNUAL MEETING OF SHAREHOLDERS

Thursday, May 12, 201616, 2019

9:00 a.m. Eastern Standard Time

PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012

We are pleased to invite you to join our Board, senior leadership and other associates of PolyOne Corporation (“PolyOne” or the “Company”) for the Annual Meeting. The purposes of the Annual Meeting are to:

| 1. | Elect |

| 2. | Approve, on an advisory basis, our Named Executive Officer compensation; |

| 3. | Ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accountants for |

| 4. | Consider and transact any other business that may properly come before the Annual Meeting. |

The Board set March 15, 201619, 2019 as the record date for the Annual Meeting and owners of record of shares of common stock of PolyOne as of the close of business on that date are eligible to:

Receive this notice of the Annual Meeting; and |

Vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting. |

Please ensure that your shares are represented at the Annual Meeting by promptly voting and submitting your proxy by telephone or over the Internet, or by completing, signing, dating and returning your proxy form in the enclosed envelope.

March 28, 2019 | For the Board of Directors

Lisa K. Kunkle

|

Important Notice Annual Meeting to be held on May

The proxy statement, proxy card and annual report to shareholders for the fiscal year ended December 31, “Investor Relations” page. |

| ii |

PROXY SUMMARY

This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

VOTING AND MEETING INFORMATION

Your vote is important to the future of the Company. Please carefully review the proxy materials for the Annual Meeting, which will be held on Thursday, May 12, 201616, 2019 at 9:00 a.m. Eastern Standard Time at PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012. Follow the instructions below to cast your vote on all of the voting matters.

We are mailing this proxy statement and the enclosed proxy card and, if applicable, the voting instruction card, to shareholders on or about April 1, 2016.March 28, 2019. Our telephone number is(440) 930-1000.

Who is Eligible to Vote

You are entitled to vote if you were a shareholder of record at the close of business on March 15, 2016,19, 2019, the record date for the Annual Meeting. Each share of common stock is entitled to one vote for each Board of Director nominee and one vote for each of the other proposals to be voted on.

Advance Voting Methods

Even if you plan to attend our Annual Meeting in person, if you are a registered holder, please cast your vote as soon as possible using one of the following advance voting methods:

visit

visit Visitwww.proxyvote.com to vote your proxyOVER THE INTERNET until 11:59 p.m.

Visitwww.proxyvote.com to vote your proxyOVER THE INTERNET until 11:59 p.m. (CT)(ET) on May 11, 2016.15, 2019.

call

call  Call1-800-690-6903 to vote your proxyBY TELEPHONE until 11:59 p.m.

Call1-800-690-6903 to vote your proxyBY TELEPHONE until 11:59 p.m. (CT)(ET) on May 11, 2016.15, 2019.

sign,

sign, Sign, date and return your proxy card/voting instruction form to voteBY

Sign, date and return your proxy card/voting instruction form to voteBY MAIMAILL.

Each shareholder’s vote is important. Please submit your vote and proxy by telephone or over the Internet, or complete, sign, date and return your proxy or voting instruction

|

Attending and Voting at the Annual Meeting

All registered holders may vote in person at the Annual Meeting. Beneficial owners may vote in person at the meeting if they have a legal proxy.

| 1 |

PROXY SUMMARY

Company Operating Performance

PolyOne again delivered both revenue and earnings growth in 20152018, growing revenue 9% and expanding adjusted earnings per share (“EPS”) 10%, representing the ninth consecutive year of 9%adjusted EPS growth. Our Color, Additives and Inks (“CAI”) segment led the way, increasing revenue and operating income 17% and 14%, despite a number of global economic headwinds. This growth was driven by record-setting performancesrespectively. Our investments in commercial resources and specialty acquisitions, guided by our established specialty businesses, Color, Additives & Inksfour-pillar strategy, helped us overcome significantly higher raw material and Engineered Materials. We will work to accelerate this growth throughlogistics costs and a demand slowdown in certain end markets and geographies during the relentless pursuit of our proven four-pillar strategy.year. Additional 20152018 Company financial performance highlights include(1):include:

● Full year 2018 Generally Accepted Accounting Principles (“GAAP”) EPS was $2.00 in 2018, compared to $2.11 in 2017. 2018 EPS was impacted by pension and environmental related charges. ● Adjusted EPS in 2018 increased to $2.43, a 10% increase from $2.21 in 2017.(1) ● Our Company has delivered nine consecutive years of significant adjusted EPS growth. ● Record performance in our |

$158.5 million, a 14% increase from 2017.

● Our investment in |

● Strong balance sheet and ● We continued to ● Since 2011, we have returned over $1.1 billion to shareholders through dividends and share repurchases. |

| (1) | Adjusted |

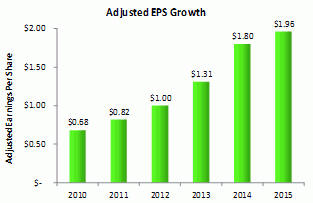

Our Company has delivered 25 consecutive quarters of strong Adjusted Earnings Per Share growth.

Adjusted Earnings Per Share Growth

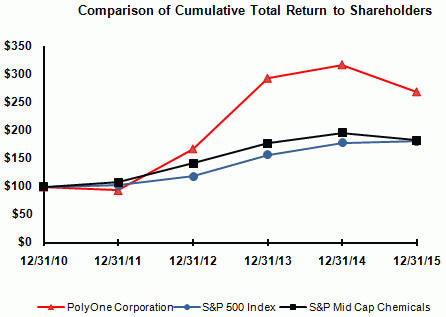

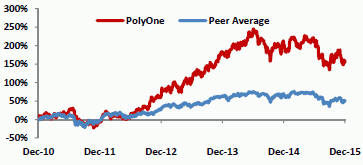

Share AppreciationCulture

Our strong performance reflects the Company has deliveredculture we strive to create, which is made possible through the dedication and hard work of our global associates. Our mission is to become the world’s premier provider of specialized polymer materials, services and solutions, as we execute our proven four-pillar strategy of Specialization, Globalization, Commercial Excellence and Operational Excellence. We, in turn, support our associates’ efforts by investing in them and aligning compensation accordingly.

Our core values of Collaboration, Innovation and Excellence, and our personal values of Integrity, Honesty and Respect, are critical to our culture and underpin all that we do.

A continuous focus on safety is one way we can take care of our people. Our 0.51 injury incidence rate last year was the safest year in the history of PolyOne and was more than seven times better than the plastics and rubber products manufacturing industry average. And, in 2018, we were certified as an ACC Responsible Care® organization for outstanding environmental, health and safety performance.

While we are proud of our safety and financial performance, we welcome the challenge of continually building upon our positive momentum, which is why we are always refining our culture. We do this by hiring the best and brightest people through robust campus and experienced recruiting, as well as by developing talent from within through unique leadership development opportunities. One such initiative is LEAD by Women, a positive returnleadership development initiative with the goal of advancing diversity and inclusion at all levels of the Company. In 2018, we were excited to shareholders over time that significantly outperformslaunch two additional resource groups. PRIDE at PolyOne was created to ensure our peer group, as reflected below.

LGBT community and its supporters can confidently bring their true selves to work each day and maximize their contributions with the full support of all PolyOne associates. We also launched HYPE, which is building a collaborative network of PolyOne’s young professionals, eager to innovate and impact our customers with the support of existing cross-generational

| 2 |

PROXY SUMMARY

expertise. All combined, the actions to build our culture resulted in a milestone recognition at PolyOne: in 2018, we were very proud to be certified as a Great Place to Work® in the U.S. from the Great Place to Work Institute.

More commentary on our work in culture and in our four cornerstones of Sustainability (People, Products, Planet and Performance) can be found in the Letter to Shareholders in our 2018 Annual Report.

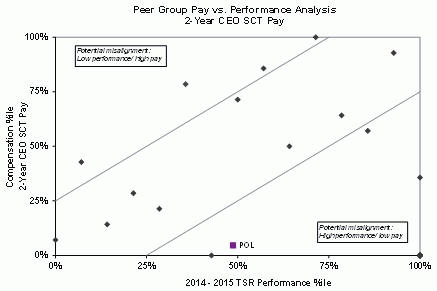

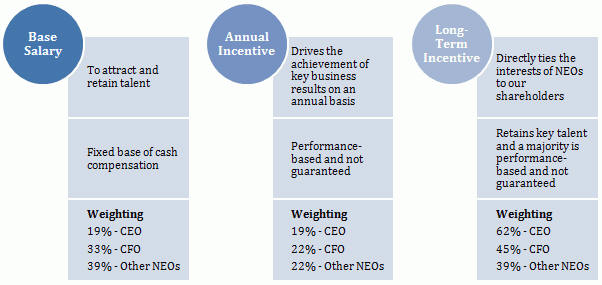

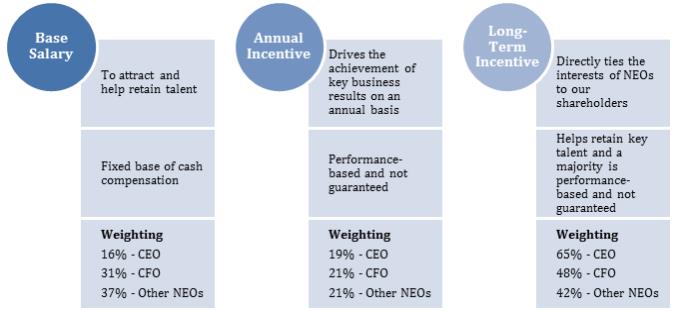

Impact of Our Performance on Named Executive Officer 20152018 Compensation

Our 20152018 compensation results continue to reflectreflected our objective pay-for-performance philosophy of aligning executive compensation directly with our financial performance.

Annual Incentive Plan

We set aggressive goals for each of our performance measures in our 20152018 annual cash incentive program (the “2015“2018 Annual Incentive Program”) under the PolyOne Corporation Senior Executive Annual Incentive Plan, as amended and restated (the “Annual Plan”). Our operational performance in 20152018 resulted in the executive officers named in the 20152018 Summary Compensation Table of this proxy statement (the “Named Executive Officers”) earning essentially a below target payout under the 20152018 Annual Incentive Program.

Our Named Executive Officers for 2018 are: Robert M. Patterson, Bradley C. Richardson, Mark D. Crist, Michael A. Garratt and Lisa K. Kunkle. Mr. Patterson, Mr. Richardson, Mr. Garratt, and Ms. Kunkle’s 2018 Annual Incentive Program as noted below.

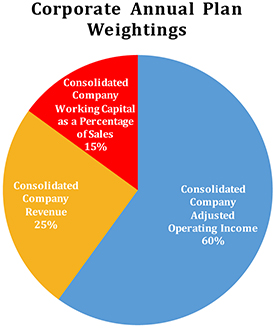

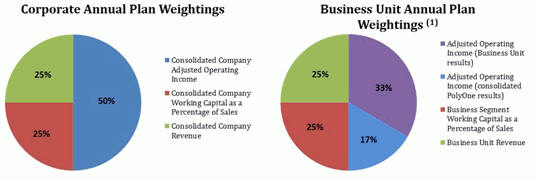

Mr. Patterson’s and Mr. Richardson’s Annual Plan opportunities arewere based on consolidated results. Total attainment for consolidated PolyOne under the 2015Mr. Crist’s 2018 Annual Incentive Program opportunity was 44.9%, with the components consisting of: (1) 50% based on consolidated Adjusted Operating Income attainment of 0% (2015 attainment of $322.3 million measured against a target of $367.9 million); (2) 25% based on Working Capital as a Percentage of Sales attainment of 179.7% (2015 attainment of 9.7% measured against a target of 10%); and (3) 25% based on Revenue attainment of 0% (2015 attainment of $3,376.5 million measured against a target of $3,933.0 million).

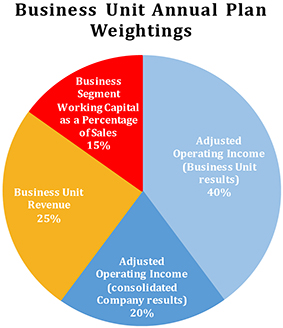

Mr. Van Hulle and Mr. Nikrant have responsibility for business unit-specific results and while theirresults. While the adjusted operating income performance goals based on Adjusted Operating Income arefor Mr. Crist’s opportunities were weighted 50%60% overall, theirthe opportunities arewere basedtwo-thirds on business unit-specific results andone-third on consolidated PolyOne Adjusted Operating Incomeadjusted operating income results. For Mr. Van Hulle, whose 2015 results were

The following table shows, for each Named Executive Officer, the target 2018 Annual Incentive Program payout opportunity, the percentage of such payout opportunity earned based on 2018 performance, and the Color, Additives and Inks Plan, total attainment was 80.0%, withdollar value of the components consisting of: (1) 33.3% based on businessactual payout.

2018 Annual Incentive Program Payouts | ||||||

| Named Executive Officer | 2018 Target Opportunity ($) | Payout (%) | Payout ($) | |||

Mr. Patterson | $1,204,615 | 99.2% | $1,194,978 | |||

Mr. Richardson | $384,000 | 99.2% | $380,928 | |||

Mr. Crist | $219,788 | 95.4% | $209,678 | |||

Mr. Garratt | $232,904 | 99.2% | $231,041 | |||

Ms. Kunkle | $223,173 | 99.2% | $221,388 | |||

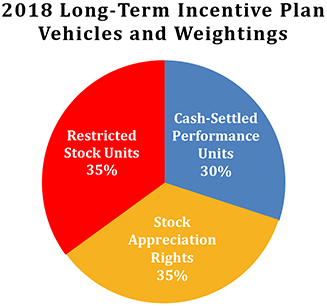

Long-Term Incentive Program

In 2018, the Named Executive Officers earned a 105% cash-settled performance unit Adjusted Operating Income attainment of 90.1% (2015 attainment of $139.6 million measured against a target of $142.7 million); (2) 16.7% based on consolidated Adjusted Operating Income attainment of 0% (2015 attainment of $322.3 million measured against a target of $367.9 million); (3) 25.0% based on Working Capital as Percentage of Sales attainment of 200.0% (2015 attainment of 9.5% measured against a target of 10.1%); and (4) 25.0% based on Revenue attainment of 0% (2015 attainment of $842.2 million measured against a target of $906.6 million). For Mr. Nikrant, whose 2015 results were based on the Specialty Engineered Materials Plan, total attainment was 70.1%, with the components consisting of: (1) 33.3% based on business unit Adjusted Operating Income attainment of 61.4% (2015 attainment of $80.8 million measured against a target of $88.8 million); (2) 16.7% based on consolidated Adjusted Operating Income attainment of 0% (2015 attainment of $322.3 million measured against a target of $367.9 million); (3) 25.0% based on Working Capital as Percentage of Sales attainment of 198.7% (2015 attainment of 9.2% measured against a target of 9.6%); and (4) 25.0% based on Revenue attainment of 0% (2015 attainment of $556.8 million measured against a target of $605.5 million).

Mr. Newlin was not eligible for a payout under the 2015 AnnualAmended and Restated PolyOne Corporation 2010 Equity and Performance Incentive Program per the terms of his Letter Agreement (as that term is defined herein). As part of her severance compensation, Ms. McAlindon received a pro-rata portion of what she would have received under the 2015 Annual Incentive Program,Plan. The payout was earned based on the amount of time during 2015 that she was with the Company.

| 2016 – 2018 Cash-Settled Performance Units

Performance Measure: Adjusted EPS | |||||||||

| Performance Periods | Weighting | Target | Result | Payout % | ||||||

January 1, 2016 – December 31, 2016 | 25% | $2.16 | $2.13 | 89% | ||||||

January 1, 2017 – December 31, 2017 | 25% | $2.20 | $2.18 | 97% | ||||||

January 1, 2018 – December 31, 2018 | 25% | $2.25 | $2.43 | 123% | ||||||

January 1, 2016 – December 31, 2018 | 25% | $6.61 | $6.74 | 109% | ||||||

Total Attainment | 105% | |||||||||

| 3 |

PROXY SUMMARY

Long-Term Incentive Plan

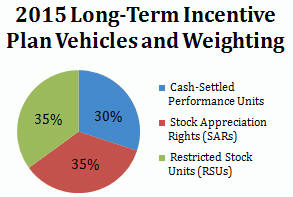

As a result of strong earnings growth measured over the past three years, in 2015, the Named Executive Officers earned a 200% cash-settled performance unit payout under PolyOne’s 2010 Equity and Performance Incentive Plan, as amended (the “Amended Long-Term Incentive Plan”). The payout was earned by PolyOne exceeding cumulative Adjusted Earnings Per Share targets over four, equally-weighted performance periods as noted below.

2013 – 2015 Cash-Settled Performance Units

Performance Measure: Adjusted Cumulative Earnings Per Share | ||||||||

| Performance Periods | Weighting | 2013 - 2015 Target | 2013 - 2015 Results | Payout % | ||||

January 1, 2013 – December 31, 2013 | 25% | $1.21 | $1.39 | 200% | ||||

January 1, 2014 – December 31, 2014 | 25% | $1.21 | $1.80 | 200% | ||||

January 1, 2015 – December 31, 2015 | 25% | $1.34 | $1.96 | 200% | ||||

January 1, 2013 – December 31, 2015 | 25% | $3.76 | $5.15 | 200% | ||||

Total Attainment | 200% | |||||||

All financial measures (targets(threshold, target and maximum levels, and results) reported inwith respect to the incentives described above tables were calculated with adjustments for acquisitions, divestitures and special items pursuant to the terms of the 2018 Annual PlanIncentive Program and 2013 - 2015 Amended2016 to 2018 long-term incentive program (the “2016-2018 Long-Term Incentive PlanProgram”) and as approved by the Board. Compensation Committee.

For information on the terms and conditions of these incentive plans,programs, see the “What We Pay and Why: Elements of Compensation” section of this proxy statement (beginningstatement.

Our Director Nominees and Committee Membership

You are being asked to vote on Page 32).the election of ten Directors. Detailed information about each Director Nominee’s background, qualifications, attributes, skills and experience can be found beginning on page 9.

| Name | Age | Director Since | Principal Position | Notable Skills and Experiences | Independent | Committee Membership* (M=Member, C=Chair) | ||||||||||||

AC

|

CC

|

N&GC

|

EH&SC

| |||||||||||||||

| Robert E. Abernathy | 64 | 2018 | Retired Chairman and Chief Executive Officer, Halyard Health, Inc. | Financial, International, Industry Experience, Regulatory, Technology, HR, Operations, Environmental, Corporate Governance

| Yes | M | M | |||||||||||

| Richard H. Fearon | 63 | 2004 | Lead Director

Vice Chairman and Chief Financial and Planning Officer, Eaton Corporation

| Financial, International, Industry Experience, Regulatory, Technology, HR, Operations, Corporate Governance

| Yes | M | C | |||||||||||

| Gregory J. Goff | 62 | 2011 | Executive Vice Chairman, Marathon Petroleum Corporation | Financial, International, Industry Experience, Technology, HR, Operations, Environmental, Corporate Governance

| Yes | M | C | |||||||||||

| William R. Jellison | 61 | 2015 | Retired Vice President, Chief Financial Officer, Stryker Corporation | Financial, International, Industry Experience, Regulatory, Technology, Operations, Corporate Governance

| Yes | C | M | |||||||||||

| Sandra Beach Lin | 61 | 2013 | Retired President, Chief Executive Officer and Director of Calisolar, Inc. | Financial, International, Industry Experience, Regulatory, Technology, HR, Operations, Environmental, Corporate Governance

| Yes | M | M | |||||||||||

| Kim Ann Mink | 59 | 2017 | Chairman, President and Chief Executive Officer, Innophos Holdings, Inc. | Financial, International, Industry Experience, Regulatory, Technology, HR, Operations, Corporate Governance

| Yes | M | M | |||||||||||

| Robert M. Patterson | 46 | 2014 | Chairman, President and Chief Executive Officer, PolyOne | Financial, International, Industry Experience, HR, Operations, Corporate Governance

| No | M | ||||||||||||

| 4 |

PROXY SUMMARY

| Name | Age | Director Since | Principal Position | Notable Skills and Experiences | Independent | Committee Membership* (M=Member, C=Chair) | ||||||||||||

AC

|

CC

|

N&GC

|

EH&SC

| |||||||||||||||

| Kerry J. Preete | 58 | 2013 | Retired Executive Vice President, Chief Strategy Officer, Monsanto Company | International, Industry Experience, Regulatory, Technology, HR, Operations, Environmental

| Yes | C | M | |||||||||||

| Patricia Verduin | 59 | 2019 | Chief Technology Officer, Colgate-Palmolive Company | International, Industry Experience, Regulatory, Technology, HR, Operations, Environmental, Corporate Governance

| Yes | M | M | |||||||||||

| William A. Wulfsohn | 57 | 2011 | Chairman and Chief Executive Officer, Ashland Global Holdings Inc. | Financial, International, Industry Experience, Technology, HR, Operations, Environmental, Corporate Governance

| Yes | M | M | |||||||||||

* Reflects expected Committee membership immediately following the Annual Meeting.

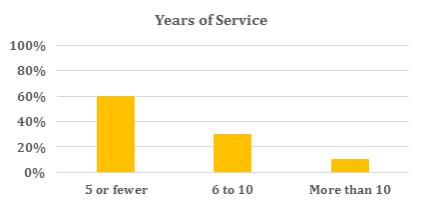

Our ten Director nominees exhibit an effective mix of diversity, experience and fresh perspective:

| Average Tenure | Average Age | Gender Diversity | ||

| 5.25 | 59 | 30% | ||

| Years | Years | Women | ||

Governance Highlights

As part of our commitment to overall excellence, our Company’s governance practices include the following:

Director Independence

| ● | Strong commitment to Director independence: Nine out of our ten Director nominees are independent |

| ● | The independent Directors regularly hold executive sessions, led by the independent Lead Director |

Independent Lead Director

| ● | The independent Directors have selected Richard H. Fearon to serve as independent Lead Director |

| ● | Among other responsibilities, the independent Lead Director: |

| ✓ | Chairs executive sessions of thenon-employee Directors and provides feedback and perspective to the Chief Executive Officer (“CEO”) regarding discussions at these sessions |

| ✓ | Facilitates communications between the Chairman of the Board and other members of the Board |

| ✓ | Provides input from the Directors to the Chairman of the Board with regard to agendas and schedules for Board meetings |

| ✓ | Advises the Chairman of the Board as to the quality, quantity and timeliness of the flow of information from management to the Board and regarding the effectiveness of Board meetings |

| ✓ | Interviews all Board candidates, and provides the Nominating and Governance Committee with recommendations on each candidate |

| 5 |

PROXY SUMMARY

| ✓ | Maintains close contact with the Chair of each standing committee and assists in maintaining communications between each committee and the Board |

| ✓ | Considers the retention of advisers and consultants who report directly to the Board |

| ✓ | Chairs Board meetings when the Chairman of the Board is unable to do so |

Board Oversight of Risk Management

The Board oversees risk management, setting appropriate “tone at the top”

The Board assesses and analyzes the most likely areas of current and future risk for the Company on anon-going basis

The Board regularly communicates with management regarding material risks and to convey its expectations clearly

Stock Ownership Requirements

We maintain robust stock ownership requirements

The stock ownership requirement for our CEO is 125,000 shares and for all other directors is 12,500 shares (within five years of onboarding)

Board Practices

Our Board annually conducts an evaluation of its performance, which includes a peer evaluation of each Director

The Nominating and Governance Committee reviews criteria for Board membership and considers changes as needed so that the Board continues to reflect the appropriate mix of skills and experience

| • | Non-employee Directors may not stand forre-election following the date of the Director’s 72nd birthday, although the Board may waive this limitation if it determines such waiver to be in the best interests of the Company |

All Directors stand for election annually

We maintain a majority voting policy for uncontested Director elections

| 6 |

POLYONE CORPORATION

PolyOne Center

33587 Walker Road

Avon Lake, Ohio 44012

PROXY STATEMENT

Dated April 1, 2016March 28, 2019

Our Board respectfully requests your proxy for use at the Annual Meeting to be held at PolyOne’s corporate headquarters located at PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012 at 9:00 a.m. on Thursday, May 12, 2016,16, 2019, and at any adjournments of that meeting. This proxy statement is to inform you about the matters to be acted upon at the meeting.

If you attend the meeting, you may vote your shares by ballot. If you do not attend, your shares may still be voted at the meeting if you vote by telephone or over the Internet, or sign and return the enclosed proxy card, or vote by telephone or over the Internetin each case, as described below. Common shares represented by a properly signed proxy card will be voted in accordance with the choices marked on the card. If no choices are marked, the shares will be voted: (1) to elect the nominees listed on pages 7 through 11 of this proxy statement; (2) to approve, on an advisory basis, our Named Executive Officer compensation for the fiscal year ended December 31, 2015; and (3) to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

You may revoke your proxy before it is voted by giving notice to us in writing or orally at the meeting. Persons entitled to direct the vote of shares held by the following plans will receive a separate voting instruction card: The PolyOne Retirement Savings Plan and the PolyOne Canada Inc. Retirement Savings Program. If you receive a separate voting instruction card for one of these plans, you must sign and return the card as indicated on the card in order to instruct the trustee on how to vote the shares held under the respective plan. You may revoke your voting instruction card before the trustee votes the shares held by it by giving notice in writing to the trustee.

You may also submit your proxy by telephone or over the Internet. The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number. These procedures allow shareholders to appoint a proxy to vote their shares and to confirm that their instructions have been properly recorded. Instructions for voting by telephone and over the Internet are printed on the proxy cards.

You may revoke your proxy before it is voted by giving notice to us in writing or orally at the meeting. Persons entitled to direct the vote of shares held by the PolyOne Retirement Savings Plan and the PolyOne Canada Inc. Retirement Savings Program will also receive a proxy and voting instruction card. If you receive a proxy and voting instruction card for one of these plans, you must sign and return the card as indicated on the card in order to instruct the trustee on how to vote the shares held under the respective plan. You may revoke your proxy and voting instruction card before the trustee votes the shares held by it by giving notice in writing to the trustee.

Common shares represented by a properly signed proxy card will be voted in accordance with the choices marked on the card. If no choices are marked, the shares will be voted: (1) to elect the nominees listed in the “Proposal 1 – Election of Board of Directors” section of this proxy statement; (2) to approve, on an advisory basis, our Named Executive Officer compensation; and (3) to ratify the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

|

ELECTION OF BOARD OF DIRECTORS

PROPOSAL 1 — ELECTION OF BOARD OF DIRECTORS

Our Board currently consists of 11 Directors. On March 9, 2016, Stephen D. Newlin notifiedPursuant to the Board that he intended to retire as a Director effective as of the Company’sretirement policy contained in our Corporate Governance Guidelines, which is described below, William H. Powell will not stand forre-election at our Annual Meeting of Shareholders on May 12, 2016.Meeting. Thus, following the Annual Meeting and, assuming the election of all of the Board nominees, our Board will consist of 10ten Directors.

Each Director serves for aone-year term until a successor is duly elected and qualified, subject to the Director’s earlier death, retirement or resignation. Our Corporate Governance Guidelines provide that allnon-employee Directors will retire from the Board not later than the Annual Meeting immediately following the Director’s 72nd birthday, although the Board may waive this limitation if it determines that such a waiver is in PolyOne’s best interests. Last year, the Board approved a resolution waiving this policy for Mr. Powell for one year while a search was conducted for a new independent director. As explained below, the Board elected Patricia Verduin in March, and, as contemplated by the Board when it waived the retirement policy for one year, Mr. Powell will not stand forre-election at our Annual Meeting.

A shareholder who wishes to nominate a person for election as a Director must provide written notice to our Secretary in accordance with the procedures specified in Regulation 12 of our Code of Regulations (“Regulations”). Generally, the Secretary must not receive the notice less than 60 nor more than 90 days prior to the first anniversary of the date on which we first mailed our proxy materials for the preceding year’s Annual Meeting. The notice must set forth, as to each nominee, among other things, the name, age, and other identifying information, principal occupation and employment during the past five years, name and principal business of any corporation or other organization in which such occupation and employment were carried on, certain information regarding Company securities ownership, and a brief description of any arrangement or understanding between such person and any others pursuant to which such person was selected as a nominee. The notice must include the nominee’s signed consent to serve as a Director if elected. The notice must set forth the name and address of, and the number of our common shares owned by, the shareholder giving the notice and the beneficial owner on whose behalf the nomination is made and any other shareholders believed to be supporting such nominee.

Following are the nominees for election as Directors for terms expiring in 2017,2019, a description of the business experience of each nominee and the names of other publicly-held companies for which he or she currently serves as a director or has served as a director during the past five years. Each nominee for election as Director was previously elected by our shareholders, other than William R. Jellison. Mr. JellisonPatricia Verduin. Dr. Verduin was recommended to our Nominating and Governance Committee for election to the Board by a third-party search firm, Korn Ferry. Mr. JellisonRussell Reynolds Associates. Dr. Verduin was subsequently recommended by our Nominating and Governance Committee to the Board for election as a Director, and the Board elected Mr. JellisonDr. Verduin as a Director on October 7, 2015.March 6, 2019. The composition of the Board is intended to reflect an appropriate mix of skill sets, experience and qualifications that are relevant to PolyOne Corporation’sPolyOne’s business and governance over time.

In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that the nominee should serve as a Director, the Board also believes that all of our Director nominees are individuals of substantial accomplishment with demonstrated leadership capabilities. Each of our Director nominees also has the following personal characteristics, which are required attributes for all Board nominees: high ethical standards, integrity, judgment and an ability to devote sufficient time to the affairs of our Company. The referenceinformation below Farah Walter’s name to the term of service as a Director includes the period during which she served as a Director of The Geon Company (“Geon”), one of our predecessors. The information is current as of March 15, 2016.19, 2019.

Our Board recommends a vote FOR

|

|

ELECTION OF BOARD OF DIRECTORS

Robert E. Abernathy Retired Chairman and Chief Executive Officer of Halyard Health, Inc., a medical technology company that focuses on eliminating pain, speeding recovery, and preventing infection for healthcare providers and patients worldwide. Mr. Abernathy served as Chief Executive Officer of Halyard Health from its spinoff from Kimberly-Clark in October 2014 until his retirement in June 2017, during which time he also served as Chairman. He continued as Chairman until September 2017. Prior to that, he worked for Kimberly-Clark, a global personal care products company. He joined Kimberly-Clark in 1982 and served in numerous roles of increasing responsibility, including President, Global Healthcare from June 2014 until October 2014 and Executive Vice President, from November 2013 to June 2014. | Qualifications, Attributes, Skills and Experience: We believe that our Company can capitalize on Mr. Abernathy’s significant global experience, particularly in developing markets. Further, Mr. Abernathy’s prior role as a Chief Executive Officer of a publicly traded company and service on several other external boards will enable him to provide relevant and topical advice on issues affecting public companies. Mr. Abernathy’s unique perspective gained while working in the healthcare and consumer products industries can add value when evaluating our commercial relationships in those industries. Current Directorships: Haemonetics Corporation Former Directorships:Halyard Health, Inc., RadioShack Corp., Lubrizol Corp., Kimberly-Clark de Mexico Age: 64 Director since:2018 |

Richard H. Fearon |

| |||||

|

| |||||

Lead Director of our Board since May 14, 2015. | Qualifications, Attributes, Skills and Experience: We believe that Mr. Fearon’s Current Directorships: Eaton Corporation plc Former Directorships: Southern Steel Bhd, Centurion Industries Ltd. Age: 63 Director since: 2004 | |||||

Gregory J. Goff Executive Vice Chairman of Marathon Petroleum Corporation, a leading, integrated, downstream energy company, since October 2018. Prior to joining Marathon, Mr. Goff served as President and Chief Executive Officer | Qualifications, Attributes, Skills and Experience: We believe that, as a Board member with proven leadership capabilities and as an executive who has extensive international business experience across Europe, Asia and Latin America, Mr. Goff provides a unique perspective on our strategy and operations. Mr. Goff’s deep understanding of the energy industry and specialty chemical businesses provides valuable insight into PolyOne’s strategic planning. His experience as the Chief Executive Officer of a large, independent refining and petroleum products marketing company and his participation as a member of national trade associations provide him with valuable experience that can enhance our Board. Current Directorships:Marathon Petroleum Corporation,Andeavor Logistics GP, LLC (the general partner of Andeavor Logistics LP), Marathon Logistics GP, LLC (the general partner of Marathon Logistics LP) Former Directorships:Andeavor,DCP Midstream CP, LLC Age: 62 Director since: 2011 |

|

ELECTION OF BOARD OF DIRECTORS

William R. Jellison |

| |||||

|

| |||||

Retired Vice President, Chief Financial Officer of Stryker Corporation, one of the world’s leading medical technology | Qualifications, Attributes, Skills and Experience:

Current Directorships: Young Innovations Former Directorships: None Age: 61 Director since: 2015 | |||||

Sandra Beach Lin Retired President, Chief Executive Officer and Director of Calisolar, Inc. (now Silicor Materials Inc.), a solar silicon | Qualifications, Attributes, Skills and Experience: We believe that Ms. Lin’s extensive senior executive experience, including as a Chief Executive Officer, leading global businesses in multiple industries provides her with valuable skills to serve on our Board. She has a deep understanding of the specialty chemicals industry, a strong operational foundation and wide-ranging international experience. Ms. Lin also serves as a director for two other public companies and one privately-held biomedical polymer company, which provides her with additional experience she utilizes while serving as a valued member of our Board. Furthermore, we believe that Ms. Lin, as a woman, enhances gender diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance. Current Directorships: WESCO International, Inc., American Electric Power Company, Inc., and Interface Biologics Inc. Former Directorships: None Age: 61 Director since: 2013 |

Kim Ann Mink Chairman, President and Chief Executive Officer, Innophos Holdings, Inc., a leading international producer of performance-critical and nutritional functional ingredients, with applications in food, health and industrial specialties markets, since 2015. Prior to joining Innophos, Dr. Mink served as Business President of Elastomers, Electrical and Telecommunications at the Dow Chemical Company, a specialty chemicals provider, from September 2012 to December 2015. She joined Dow in April 2009 as Global General Manager, Performance Materials and President and Chief Executive Officer of ANGUS Chemical Co. (then a fully-owned subsidiary of Dow Chemical). Prior to joining Dow, she was Corporate Vice President and Global General Manager, Ion Exchange Resins at the Rohm and Haas Company (now a fully-owned subsidiary of Dow), where she spent more than 20 years serving in numerous senior roles with increasing responsibilities. | Qualifications, Attributes, Skills and Experience: We believe Dr. Mink provides us with valuable counsel related to her chemical and advanced materials background. Further, her experience as a Chief Executive Officer of a public company provides PolyOne with a diverse perspective when forming strategies to guide the direction of our Company. PolyOne also benefits from her experience and expertise in technology and varied end markets. Furthermore, we believe that Ms. Mink, as a woman, enhances gender diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance. Current Directorships: Innophos Holdings, Inc., Eastman Chemical Company Former Directorships: None Age: 59 Director since: 2017 |

|

ELECTION OF BOARD OF DIRECTORS

| Robert M. Patterson | |||||

|

| |||||

| Chairman, President and Chief Executive Officer of PolyOne since May | Qualifications, Attributes, Skills and Experience: We believe that, as our Chief Executive Officer and in light of his prior executive experience, Mr. Patterson is particularly well qualified to serve on our Board and as our | ||||

Current Directorships: None

Former Directorships: None

Age: 46

Director since: 2014

|

ELECTION OF BOARD OF DIRECTORS

| Kerry J. Preete | |||||||

|

| |||||||

| Retired Executive Vice President, | Qualifications, Attributes, Skills and Experience: Because of his broad experience at a leading, well-known company, we believe Mr. Preete brings an insightful perspective on running a successful, innovative company. Mr. Preete is specifically adept in not only thinking strategically, but also tactically, and these traits will be valuable to PolyOne as it continues into the future. Further, his global experience and understanding will assist PolyOne in its plans to operate in different regions and cultures, and we believe his global business acumen is relevant and transferable across industries. Mr. Preete’s operational foundation, strategic expertise, and global experience are assets to PolyOne’s Board. Current Directorships: Univar Inc. Former Directorships: None Age: 58 Director since: 2013 | ||||||

Patricia Verduin Chief Technology Officer for Colgate-Palmolive Company, a leading consumer products manufacturer, since 2011. Dr. Verduin was Colgate-Palmolive Company’s Vice President, Research and Development from 2007 to 2011. Prior to joining Colgate-Palmolive, Dr. Verduin served as Senior Vice President and Chief Science Officer, Grocery Manufacturers Association from 2006 to 2007, as Senior Vice President of Product Quality and Development, ConAgra Foods, Inc. (now Conagra Brands, Inc.) from 2002 to 2006, and as Senior Vice President of Research and Development, Grocery Products Development, ConAgra Foods, Inc. from 2000 to 2002. | Qualifications, Attributes, Skills and Experience: As our newest Board member, we believe that Dr. Verduin’s experience leading large global science, technology and innovation teams in the corporate setting will provide a unique perspective to our Board. Her current role as a Chief Technology Officer and prior roles in science, innovation and product development will provide valuable insight into leading an innovative company and will allow her to provide expert guidance to our management and Board on our technology and innovation strategies. Furthermore, we believe that Dr. Verduin, as a woman, enhances gender diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance. Current Directorships: None Former Directorships: Monsanto Company Age: 59 Director since: 2019 |

|